Ava Risk Group Limited (ASX: AVA) (“Ava Risk Group” or “the Company”) announces its half year results for the six months ended 31 December 2023.

Highlights

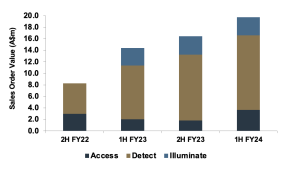

- Record group sales order intake of $19.7 million, up 37% on the previous year

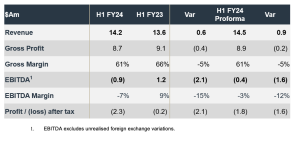

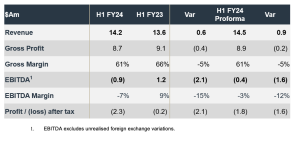

- Group revenue of $14.2 million grew 4% on the previous year

- Significant orders in major infrastructure projects in Australia and Latin America secured

- Major supply agreement with Telstra Group announced in February 2024

- Group gross margins of 61% in line with expectations

- Group EBITDA of $(0.9) million following successful investment in technology and commercial capabilities yielding record sale order intake

Ava’s record sales order intake for the half reflects its strategy to grow revenue from its market leading technologies by increasing market share and developing new and adjacent applications. The Group reported record sales order intake of $19.7m, up 37% on the previous year, underpinned by the investment made in its technology and commercial capability.

Review Appendix 4D and H1FY2024 Financial Report

Review H1FY2024 Investor Presentation

Ava Risk Group CEO Mal Maginnis said: “In the first half, we have pursued growth and this forward investment has paid off nicely, producing record sales orders and a very solid backlog. Whilst our cost base has increased, this has been necessary to right size the business ahead of the execution of large scale opportunities, including with Telstra and UGL. We are pleased with the strong sales momentum in the first half, which provides confidence in the outlook for FY24 and beyond. We secured a number of important orders during the half, including major infrastructure projects in Australia and Latin America, demonstrating the versatility of our market-leading fibre sensing technology. Early in the second half we were delighted to announce the supply agreement with Telstra, the culmination of extensive collaboration and successful product trials, and a clear demonstration of the adaptability of the Group’s technology to adjacent applications – opening significant new markets to Ava.”

“We are also demonstrating the benefit of the changes made to our commercial team and product offering over the past year to drive growth. While there is a lag in the conversion of sales orders to revenue, we are building a solid confirmed order backlog in the Detect business which will improve the predictability of future revenue. I believe we are well placed to continue our growth trajectory during H2 FY2024.”

Total revenue of $14.2m grew 4% on the previous year ($13.6m for H1 FY23). Total revenue reflects lower Detect revenue (down $0.8 million compared to the prior year) which was offset by improved performance in Access.

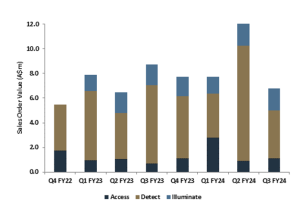

The Detect segment continued to see strong sales order intake. Aura Ai-X, the Company’s latest generation fibre sensing technology, continues to be developed to improve system performance and meet market needs. Since its launch in March 2023, Aura Ai-X has been critical to Ava’s success in key large scale contract awards such as a transport infrastructure project in Australia and a mine site application in Chile, which were both won during the first half. While lower revenue primarily in Q1 was affected by the timing of sales order intake, strong Q2 sales order intake leaves Detect well placed for a stronger H2.

In the Access segment growth in sales order intake of 80% and revenue growth of 60% on the prior year was underpinned by the completion of product certifications for the Cobalt series locks, which has resulted in stocking orders from dormakaba under its global framework agreement. Initial orders from dormakaba North America and Europe were received during the first half and fulfilled by January 2024.

The Illuminate segment has performed well with an improvement in domestic orders in the UK and a continued focus on new export markets leveraging the Company’s sales capability in Australia and North America. A new “LoRa” product has been developed which will enable the seamless integration of a number of the Company’s devices in a common solution. It is expected that “LoRa” will be launched in the second half of the year.

Chart 1 – Sales Orders

Financial Summary

Gross margins within each operating segment remain in line with expectations and are expected to improve at a consolidated level as Detect revenue increases. The decline in gross margin at a consolidated level was due to the change in revenue mix, with lower revenue in the higher margin Detect segment offset by increased revenue in the lower margin Access segment during H1. The EBITDA loss was attributable to the upfront impact of technology and commercial capability investments which were not offset by incremental revenue during H1.

The Company had a cash balance of $1.8 million at 31 December 2023. Stronger cash generation is expected in H2 based on improved revenue and sales order intake in Q2 FY24.

Outlook

We forecast H2 FY24 revenue of $16-20 million, dependent on the timing of project fulfilment. Further revenue guidance for the second half of the year will be provided in the Q3 FY24 Trading Update based on Q3 sales order intake.

Investor Webinar

Chairman David Cronin, CEO Mal Maginnis and CFO Neville Joyce will host a Zoom webinar to present the results at 10.30am AEDT today. To register for the webinar, please select the following link:

https://us06web.zoom.us/webinar/register/WN_3K-6ZUH6QwiIqPBZsfvpig

ENDS

Approved for release by the Board of Directors.

For further information, please contact:

Investor Enquiries

Alexandra Abeyratne

Citadel-MAGNUS

aabeyratne@citadelmagnus.com

+61 438 380 057

About Ava Risk Group

Ava Risk Group is a global leader in providing technologies and services to protect critical and high value assets and infrastructure. It operates three business segments – Detect, Access and Illumination. The Detect segment manufactures and markets ‘smart’ fibre optic sensing systems for security and condition monitoring for a range of applications including perimeters, pipelines, conveyors, power cables and data networks. Access is a specialist in the development, manufacture and supply of high security biometric readers, security access control and electronic locking products. Illumination specialises in the development and manufacture of illuminators, ANPR cameras and perimeter detectors. Ava Risk Group products and services are trusted by some of the most security conscious commercial, industrial, military and government clients in the world. www.avariskgroup.com

You must be logged in to post a comment.